The cryptocurrency market, known for its volatility, is currently experiencing a downturn. Total market capitalization has dropped significantly, with leading cryptocurrencies like Bitcoin and Ethereum experiencing substantial losses. This downturn has left many investors wondering about the safety of cryptocurrency investments and seeking guidance on navigating this turbulent market.

Deciphering the Crypto Market Downturn

Several factors contribute to the current state of the cryptocurrency market:

- Global Economic Uncertainty: Geopolitical tensions, rising inflation, and fears of a potential recession contribute to a risk-averse sentiment among investors, leading them to pull back from volatile assets like cryptocurrencies.

- Interest Rate Hikes: The Bank of Japan’s decision to raise interest rates has impacted carry trades, a strategy where traders borrow in low-interest-rate currencies like the yen and invest in higher-yielding assets, including cryptocurrencies. This move has led to a sell-off in crypto markets as traders unwind these positions.

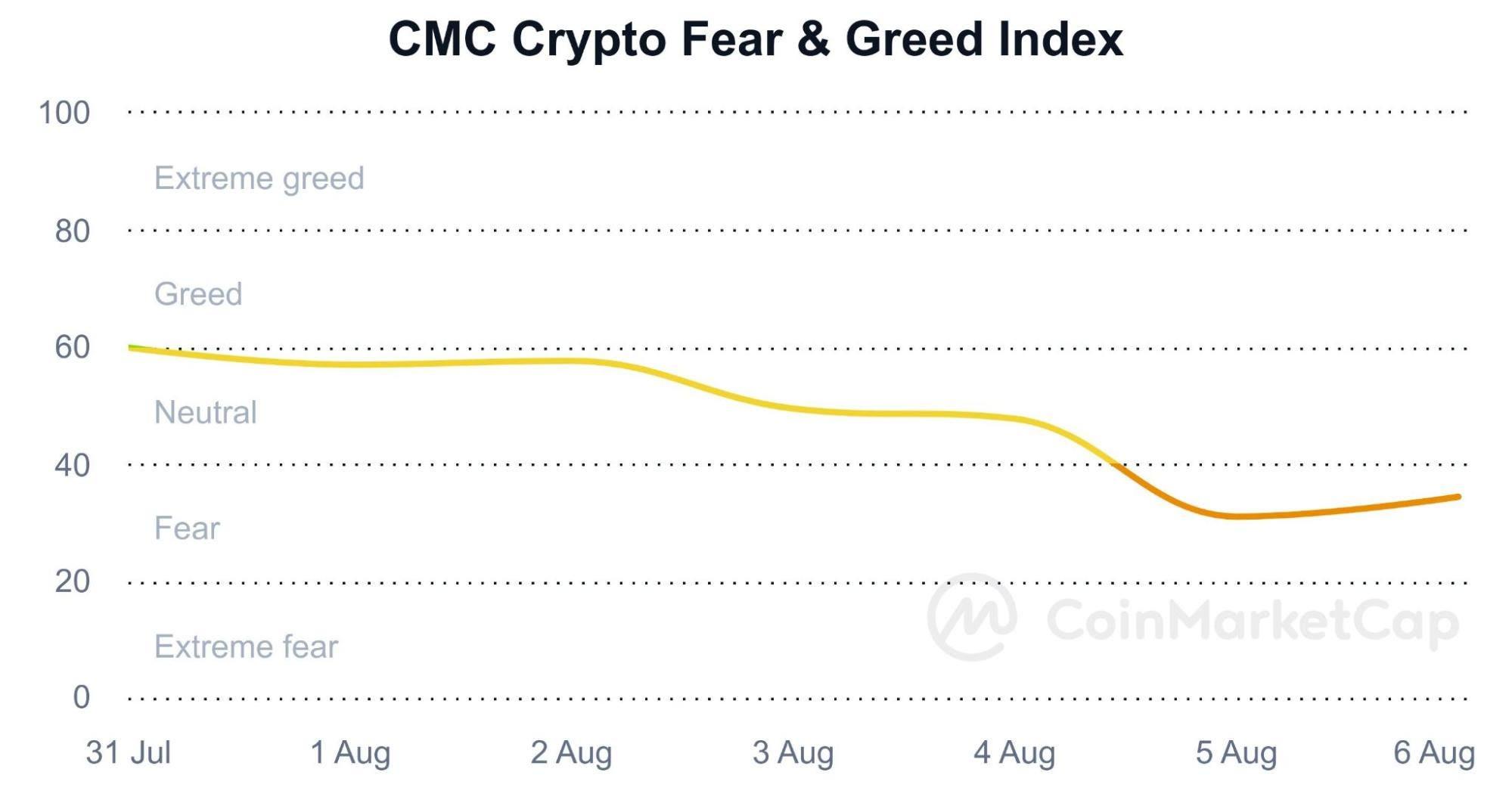

- Market Sentiment: The Fear and Greed Index, a metric reflecting market sentiment, currently indicates “fear,” highlighting the prevailing uncertainty and apprehension among investors.

CoinMarketCap Fear and Greed Index

CoinMarketCap Fear and Greed Index

Impact on Major Cryptocurrencies

The downturn has impacted major cryptocurrencies significantly:

- Bitcoin: The price of Bitcoin, the world’s largest cryptocurrency by market capitalization, has fallen significantly.

- Ethereum: Ethereum, the second-largest cryptocurrency, has also experienced a substantial price drop.

- Altcoins: Altcoins, alternative cryptocurrencies to Bitcoin and Ethereum, have not escaped the downturn, with many experiencing double-digit percentage losses.

Is Cryptocurrency a Safe Investment in 2024?

The cryptocurrency market is inherently volatile and subject to significant fluctuations. While it offers potential for high returns, it also carries substantial risk.

Here’s what to consider:

- Risk Tolerance: Assess your risk tolerance. Cryptocurrency is a high-risk asset class, and investing in it requires a long-term perspective and the ability to withstand potential losses.

- Diversification: Diversify your investment portfolio. Allocate only a small percentage of your overall portfolio to cryptocurrencies to mitigate risk.

- Due Diligence: Thoroughly research and understand the fundamentals of any cryptocurrency before investing. Consider factors such as the technology behind it, its use cases, and the team behind its development.

Navigating the Downturn: Strategies for Investors

- Stay Informed: Keep abreast of market trends, news, and expert analysis to make well-informed investment decisions.

- Avoid Panic Selling: Avoid making impulsive decisions based on short-term market fluctuations. Panic selling can result in locking in losses.

- Consider Dollar-Cost Averaging: Dollar-cost averaging, investing a fixed amount at regular intervals, can help mitigate the impact of volatility.

- Seek Professional Advice: Consult with a qualified financial advisor to discuss your investment goals and risk tolerance and develop a personalized investment strategy.

A Look Ahead: Potential and Uncertainty

The cryptocurrency market remains in a state of flux, characterized by both potential and uncertainty. While the current downturn presents challenges, it also offers opportunities for investors with a long-term perspective.

Here are some potential future trends:

- Increased Regulation: Governments worldwide are expected to introduce more comprehensive regulations for cryptocurrencies, aiming to protect investors and prevent illicit activities.

- Institutional Adoption: Continued institutional adoption of cryptocurrencies could provide a boost to the market.

- Technological Advancements: Ongoing technological advancements, such as the development of decentralized finance (DeFi) applications and the metaverse, could drive further innovation and growth in the crypto space.

Conclusion

The cryptocurrency market is navigating a period of significant volatility. While the downturn presents challenges, it also underscores the importance of informed decision-making, risk management, and a long-term investment horizon. As the market evolves, staying informed, adapting to changing conditions, and seeking professional guidance will be crucial for investors seeking to navigate the dynamic world of cryptocurrencies.