The digital asset market is abuzz with renewed optimism as Bitcoin ETFs gain traction, signaling a potential bull market on the horizon. While Bitcoin often steals the limelight, astute investors are closely monitoring the movements of altcoins, seeking opportunities beyond the realm of the leading cryptocurrency. This exploration delves into the dynamics of capital rotation within the altcoin market, examining how liquidity and trading activity are shaping the landscape and hinting at the potential for an altcoin resurgence.

The Altcoin Momentum: A Measured Approach

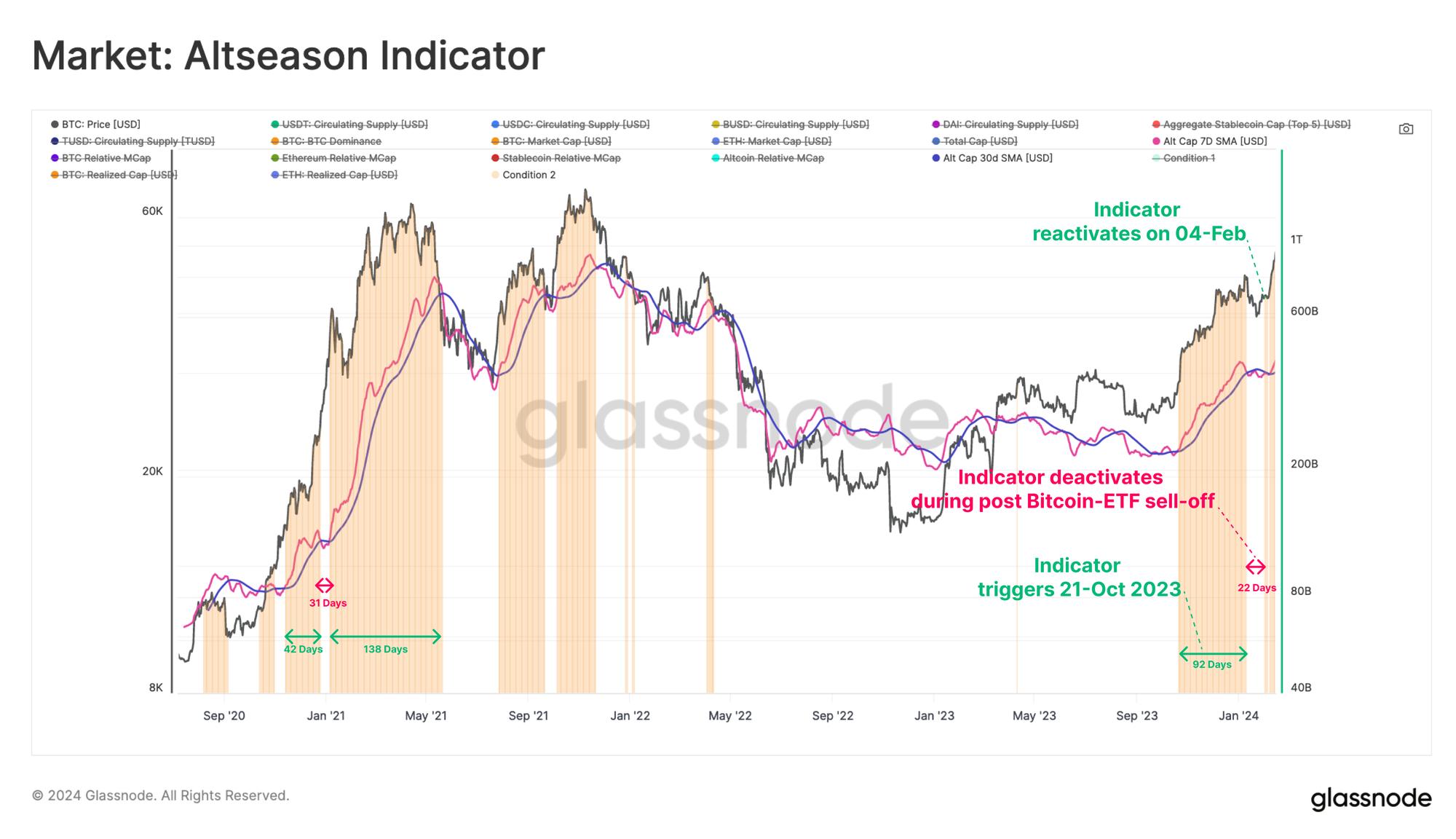

Since October of last year, a noticeable shift in investor sentiment has been brewing. The Glassnode Altseason Momentum Indicator, a metric that tracks capital flows and market trends, suggests a growing appetite for risk as investors dip their toes further into the altcoin waters.

Despite Bitcoin maintaining its dominance with over half of the total digital asset market share, early signs reveal a gradual rotation of capital towards promising ecosystems like Ethereum, Solana, Polkadot, and Cosmos. This measured approach suggests a degree of caution as investors seek confirmation of a sustained upward trend.

Ethereum, often dubbed the silver to Bitcoin’s gold, exhibits promising signals. Its year-to-date gains have outpaced Bitcoin’s, indicating a potential decoupling and independent growth trajectory.

This historical pattern suggests that capital injections into Bitcoin often precede similar movements in Ethereum, followed by a more gradual flow into altcoins. This staggered approach highlights the risk-averse nature of capital allocation in the crypto space.

Sector Spotlight: Unveiling Opportunities

To truly understand the nuances of the evolving altcoin landscape, a granular examination of specific sectors is essential. By dissecting the performance of leading tokens within each ecosystem, we can uncover potential hotspots for investment.

Solana, known for its high-speed transactions and scalability, has taken center stage in recent times. Its volatility, while a double-edged sword, has translated into impressive returns, outperforming both Polkadot and Cosmos in terms of market cap growth.

Within the Ethereum ecosystem, a tale of three sectors emerges: DeFi, GameFi, and Staking. While all three have witnessed capital inflows this year, DeFi and GameFi experienced significant outflows throughout 2022 and 2023.

The GameFi sector, however, has staged a remarkable comeback. October 2023 marked a turning point, coinciding with the positive trigger of the Altcoin Indicator. This resurgence suggests renewed interest in blockchain-based gaming and its potential to disrupt the industry.

Staking, on the other hand, has demonstrated consistent capital inflows, albeit at a smaller scale. This steady growth speaks to the allure of passive income generation and the role of staking in securing Proof-of-Stake blockchains.

Decoding Uniswap: A Window into Altcoin Sentiment

Uniswap, a decentralized exchange renowned for its vast liquidity pools and diverse trading pairs, provides valuable insights into the shifting tides of altcoin sentiment. By analyzing liquidity provision and trading volume, we can gain a deeper understanding of how investors are navigating the altcoin frontier.

A resurgence in altcoin trading on Uniswap is unmistakable. Since October 2023, trading activity has surged, encompassing tokens beyond the top 10. This renewed interest extends to tokens ranked between 10 and 20, indicating a willingness to explore beyond the most established names.

However, a disparity emerges when we examine liquidity provision versus actual trading volume. While liquidity has expanded to encompass longer-tail assets, trading activity for tokens ranked 20 to 50 and beyond remains relatively stagnant.

This divergence suggests a degree of caution. Liquidity providers, often more in tune with market movements, are positioning themselves for potential volatility and price swings. Traders, however, appear to be biding their time, awaiting further confirmation before fully committing capital.

Market Depth: A Tale of Two Forces

The concept of market depth is crucial in understanding the dynamics of liquidity and price volatility. It refers to the ability of an asset to be bought or sold without significantly impacting its price.

An analysis of liquidity distribution across various price ranges for leading Ethereum sector tokens reveals a fascinating dichotomy. Liquidity providers have increased market depth for price fluctuations of -5% and +5%, indicating an anticipation of heightened volatility in the near future.

This preparation for potential price swings further underscores the cautious optimism permeating the altcoin market. Investors are hedging their bets, providing liquidity to accommodate potential volatility while closely monitoring market signals.

Charting the Course: A Measured Approach to Altcoin Exploration

The altcoin market is at a crossroads. While the momentum indicators point towards a potential resurgence, a degree of caution and measured approach prevails. Liquidity providers are laying the groundwork, anticipating volatility and positioning themselves for potential price movements.

Traders, however, are adopting a more hesitant stance, awaiting further confirmation and stronger signals before fully committing capital. This delicate dance between liquidity and trading activity will ultimately determine the trajectory of the altcoin market.

As the digital asset landscape continues to evolve, a strategic approach is paramount. Investors are well-advised to prioritize due diligence, thoroughly research individual projects and ecosystems, and understand the nuances of market depth and liquidity before venturing into the exciting, albeit volatile, realm of altcoins.